Not known Factual Statements About Pkf Advisory Services

Not known Factual Statements About Pkf Advisory Services

Blog Article

Fascination About Pkf Advisory Services

Table of ContentsExcitement About Pkf Advisory ServicesNot known Details About Pkf Advisory Services The Of Pkf Advisory Services5 Simple Techniques For Pkf Advisory ServicesPkf Advisory Services Can Be Fun For Anyone

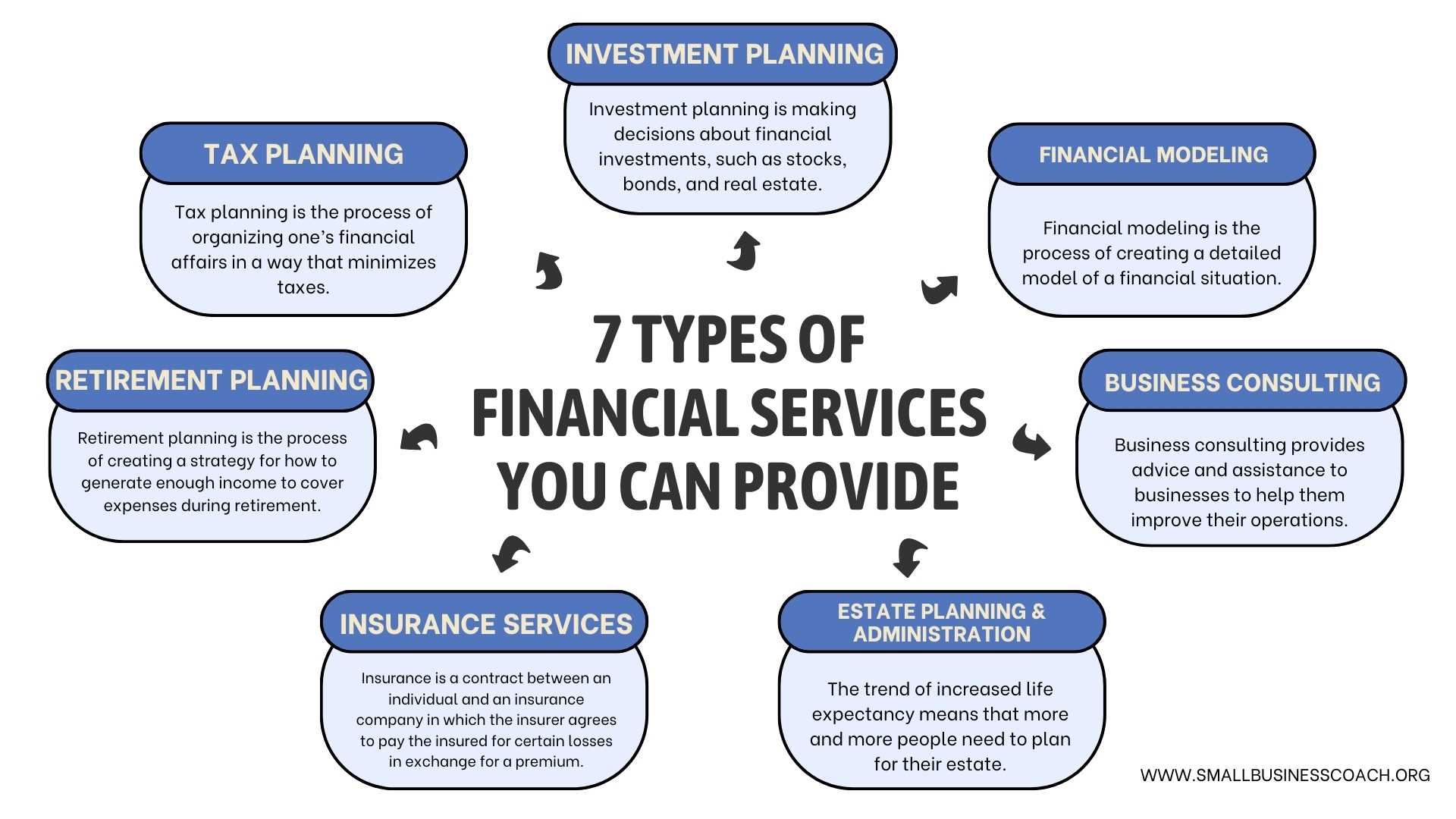

The majority of people these days understand that they can not depend on the state for even more than the outright fundamentals. Planning for retired life is a complex company, and there are numerous different options available. A monetary advisor will not only help sort through the numerous policies and product options and help create a profile to maximise your long-term potential customers.

Getting a home is one of the most pricey choices we make and the substantial bulk of us need a home mortgage. An economic consultant might conserve you thousands, especially at times similar to this. Not just can they choose the most effective rates, they can aid you analyze practical levels of loaning, take advantage of your down payment, and might additionally locate lending institutions who would or else not be readily available to you.

5 Simple Techniques For Pkf Advisory Services

A financial advisor knows exactly how products function in different markets and will certainly identify possible disadvantages for you in addition to the possible benefits, to make sure that you can then make an enlightened decision regarding where to spend. Once your threat and investment evaluations are full, the next step is to check out tax; also the most fundamental introduction of your position could aid.

For much more challenging setups, it could indicate relocating assets to your spouse or children to maximise their individual allocations rather - PKF Advisory Services. A financial advisor will certainly always have your tax setting in mind when making suggestions and factor you in the right direction even in difficult scenarios. Also when your investments have been established and are going to strategy, they should be kept track of in situation market advancements or irregular events push them off course

They can evaluate their performance versus their peers, ensure that your asset allowance does not come to be altered as markets vary and help you combine gains as the due dates for your best objectives relocate closer. Money is a challenging topic and there is whole lots to consider to protect it and maximize it.

The Single Strategy To Use For Pkf Advisory Services

Employing an excellent economic advisor can puncture the hype to steer you in the right instructions. Whether you require general, useful guidance or a specialist with dedicated competence, you might find that in the lengthy term the cash you invest in professional suggestions will be paid back many times over.

Keeping these licenses and accreditations requires constant education, which can be pricey and lengthy. Financial advisors require to stay upgraded with the most up to date market patterns, regulations, and ideal practices to offer their clients properly. In spite of these challenges, being a licensed and licensed economic advisor offers immense benefits, consisting of various occupation opportunities and greater earning possibility.

The Ultimate Guide To Pkf Advisory Services

Financial advisors work closely with customers from varied histories, aiding them browse complicated monetary decisions. The ability to listen, comprehend their special requirements, and supply tailored guidance makes all the difference.

I started my job in business money, relocating about and up like it throughout the corporate finance framework to hone skills that prepared me for the duty I remain in today. My option to move from company financing to personal financing was driven by personal needs along with the need to assist the many people, households, and local business I currently offer! Attaining a healthy work-life equilibrium can be testing in the early years of a financial expert's occupation.

The monetary advising occupation has a positive expectation. It is expected to grow and develop continually. The task market for individual monetary advisors is forecasted to grow by 17% from 2023 to 2033, showing strong need for these services. This development is driven by elements such as a maturing population calling for retirement preparation and raised recognition of the relevance of financial planning.

Financial consultants have the unique capability to make a substantial effect on their customers' lives, helping them accomplish their monetary goals and secure their futures. If you're enthusiastic concerning finance and assisting others, this job path may be the ideal suitable for you - PKF Advisory Services. To find out more information regarding coming to be a financial advisor, download our comprehensive FAQ sheet

Getting My Pkf Advisory Services To Work

It does not have any kind of financial investment suggestions and does not resolve any kind of individual truths and scenarios. Therefore, it can not be depended on as offering any type of investment advice. If you would certainly like investment advice concerning your details truths and situations, please get in touch with a qualified financial expert. Any type of investment involves some level of danger, and different kinds of investments involve differing degrees of danger, including loss of principal.

Past performance of any type of safety and security, indices, method or allowance might not be a measure of future results. The historic and existing information regarding policies, legislations, standards or advantages included in this paper is a recap of information acquired from or prepared by various other sources. It has actually not been independently confirmed, yet was gotten from sources believed to be news trusted.

A monetary expert's most important possession is not knowledge, experience, and even the capacity to create returns for clients. It's review trust, the structure of any kind of successful advisor-client relationship. It sets a consultant besides the competitors and maintains customers returning. Financial professionals across the country we spoke with agreed that count on is the crucial to developing enduring, effective relationships with clients.

Report this page